+48 (22) 520 50 00

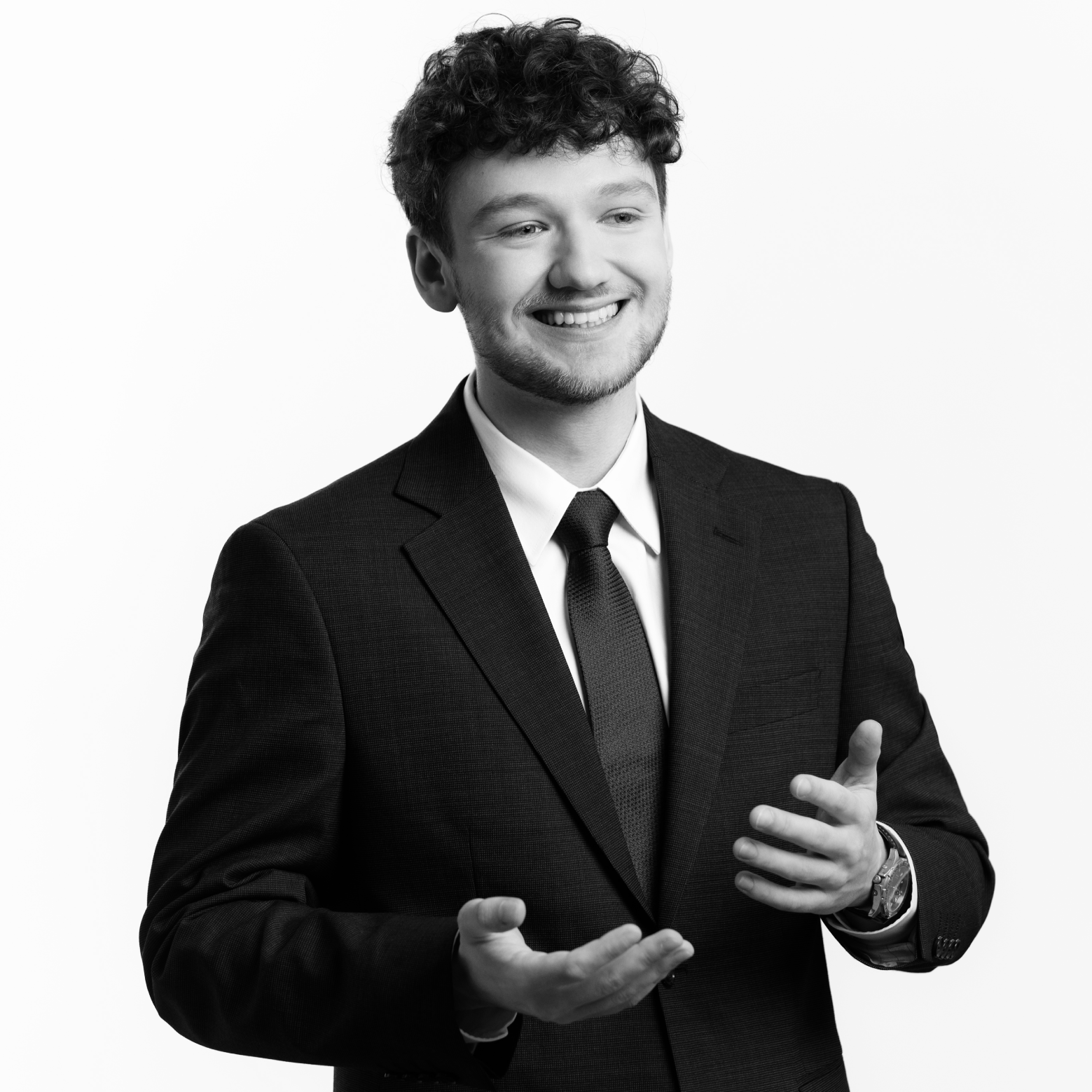

Piotr Karwat

Partner

Legal advisor. Doctor of Law. His practice focuses on tax law and public finance law. Piotr represents clients in tax matters before tax authorities and administrative courts. He is defence counsel in fiscal penal cases that follow tax proceedings. Piotr represents clients before common courts in cases brought against the State Treasury and by the State Treasury against clients regarding claims pursued in connection with earlier tax and enforcement proceedings. He was a member of Tax Law Advisory Council set up by the Minister of Finance in 2014.

With our law firm since 2008.

Practice Areas

- Tax Law

- Public Finance Law

- Fiscal penal law

- Administrative Procedure and Proceedings at Administrative Courts

- Criminal proceedings

Representative Experience

- Successfully represented a client before the Supreme Administrative Court in a case in which the Court set aside decisions defining an income tax liability based on the alleged “abuse of law” (before the general anti-abuse rule entered into force)

- Successfully represented a client before administrative courts of both instances in a case in which the decision was set aside and proceedings discontinued relating to the liability of management board members of foreign companies for tax debt of these companies – due to the lack of legal grounds for such liability

- Successfully represented a client before customs and tax authorities in a case in which tax proceedings were discontinued relating to the remitter’s liability for failure to withhold tax (WHT) on dividends – demonstrated the lack of prerequisites for the application of the so-called small anti-avoidance rule

- Successfully represented a client in an action for damages against the State Treasury where the client had faced unlawful enforcement measures as part of administrative enforcement proceedings

- Successfully defended a client whose tax debt had been time-barred but still the State Treasury raised an undue enrichment claim

- Successfully defended a client in a case brought by the State Treasury against a buyer of real estate charged with a compulsory mortgage securing a tax debt that had become time-barred

- Successfully recovered, as a result of proceedings before administrative courts, an amount overpaid by the remitter who incorrectly withheld tax on remuneration paid for redemption of shares to an entity that had acquired a debt claim in this regard from an ex-shareholder

- Successfully recovered before a common court (social security court) an overpaid accident insurance contribution charged by the Polish Social Insurance Institution (ZUS) at a rate that was too high and did not account for the right to a lower rate that was acquired through universal succession as a result of merger

- Successfully recovered, in the course of procedures before customs authorities, overpaid excise duty charged on gaming machines

- Successfully recovered, in the course of procedures before customs authorities, overpaid excise duty charged on alcohol that was made in the process of non-alcoholic beverages production

Memberships and Affiliations

- Member of the Regional Chamber of Legal Advisors in Warsaw

- Member of the Higher Disciplinary Court at the National Chamber of Legal Advisors until 2024

- Since 2024 Chairman of the Regional Disciplinary Court at the Regional Chamber of Legal Advisors in Warsaw

- Member of the International Fiscal Association (IFA)

- Adjunct Professor in the Department of Administrative and Financial Corporate Law, College of Business Administration, at the Warsaw School of Economics

Honours

- Chambers Europe (2015 – 2025)

- Legal 500 (2018 – 2024)

- International Tax Review: „Tax Controversy Leaders” (2019 – 2024)

Publications

- Tax Compliance and Risk Management Perspectives from Central and Eastern Europe, co-author, co-editor, Routledge, 2023

- Opodatkowanie spółek (English: Taxation of Partnerships and Companies), co-author, Wolters Kluwer, 2021

- Anti-abuse and anti-evasion measures in the VAT system of European countries as a key factor of sustainable development in: The Economics of Sustainable Transformation, Routledge, 2021

- Reklasyfikacja i pominięcie transakcji między podmiotami powiązanymi a ogólna klauzula przeciwko unikaniu opodatkowania (English: Reclassification and omission of related party transactions and General Anti-Avoidance Rule) in: “Współczesne problemy prawa podatkowego: teoria i praktyka: księga jubileuszowa dedykowana Profesorowi Bogumiłowi Brzezińskiemu” (English: Contemporary problems of tax law: theory and practice: a jubilee book dedicated to Professor Bogumił Brzeziński), Wolters Kluwer, 2019

- Sądowoadministracyjna kontrola decyzji podatkowej wydanej z zastosowaniem przepisów o cenach transferowych (English: The administrative court’s review of a tax decision that applies transfer pricing provisions), in: “Przegląd Podatkowy”, Wolters Kluwer, no. 11/2018

- Przepisy o cenach transferowych a ogólna klauzula przeciwko unikaniu opodatkowania. Kolizja czy synergia? (English: Transfer pricing provisions vs General Anti-Avoidance Rule. Conflict or synergy?), in: „Nowe narzędzia kontrolne dokumentacyjne i informatyczne w prawie podatkowym” (English: New documentary and IT control tools in tax law), Wolters Kluwer, 2018

- Opodatkowanie spółek (English: Taxation of Partnerships and Companies), co-author, Wolters Kluwer, 2016

- Global Legal Insights. Corporate Tax, Chapter: Poland, 2nd Edition, Global Legal Group, 2014

- Global Legal Insights. Corporate Tax, Chapter: Poland, 1st Edition, Global Legal Group, 2013

- Changes to the Polish Fiscal Code in: “International Tax Planning Review”, Bloomberg BNA, November 2013

- Interes fiskalny państwa a interes podatnika. Kontrowersje związane z wprowadzeniem w Polsce ogólnej klauzuli przeciwdziałającej unikaniu opodatkowania (English: The fiscal interests of the State vs the interests of the taxpayer. Controversy over the introduction of a general anti-abuse rule in Poland), co-author, in: “Interes publiczny a interes prywatny w prawie” (English: The Public Interests vs the Private Interests in the Law), WPiA UW (Department of Law and Administration, the University of Warsaw), 2012

- Skutki złożenia pełnomocnictwa do akt postępowania podatkowego w zakresie umocowania do reprezentowania strony przed sądem administracyjnym (English: The consequences of submitting a power of attorney to the case file in tax proceedings regarding the appointment to represent a party in administrative court), in: “Wykładnia i stosowanie prawa podatkowego. Węzłowe problemy” (English: Interpretation and Application of Tax Law. Key Problems), Wolters Kluwer, 2013

- Prawo podatkowe przedsiębiorców (English: Undertakings’ Tax Law), co-author, 7th Edition, Wolters Kluwer, 2013

- Dyrektywa VAT 2006/112/WE. Komentarz (English: VAT Directive 2006/112/EC. A Commentary), co-author, Unimex, 2012

- Retroactivity of Tax Legislation, Report on Poland, European Association of Tax Law Professors, 2013

- Obejście prawa podatkowego (English: Circumvention of Tax Law), Dom Wydawniczy ABC, 2002

Education

- Faculty of Law and Administration at the University of Warsaw, Master of Law, 1996

- Financial Law Department of the Faculty of Law and Administration at the University of Warsaw, Doctor of Law, 2001

Foreign Languages

- English

I love the music of W. Młynarski, J. Wasowski and J. Przybora, A. Osiecka, L. Cohen and classical music. I am fond of the 1930s movies and I am an enthusiast of hiking, especially in Slovakia’s Tatra mountains, though I am still passionate about Poland’s Tatra mountains and even more so recently.